Criteria for Capitalising vs. Expensing Lean Six Sigma Consultant Costs under FRS 102 Section 18

Navigating Lean Six Sigma

Business Consultancy Costs

When investing in Lean Six Sigma consultancy services, businesses often wonder if these costs can be capitalised or should be expensed in their financial statements. Following the FRS 102 Section 18 standards is essential for businesses in the UK to ensure compliance. This guide breaks down when to capitalise and when to expense these consultancy costs, helping you make informed financial decisions.

Capitalising vs Expensing Lean Six Sigma Consultancy Costs

Capitalising or expensing consultancy costs can impact your business’s financials significantly. Capitalising consultancy costs means recognising them as an intangible asset, potentially enhancing your balance sheet. In contrast, expensing costs immediately recognises them in the profit and loss statement, impacting current-period expenses.

FRS 102 Section 18 Overview

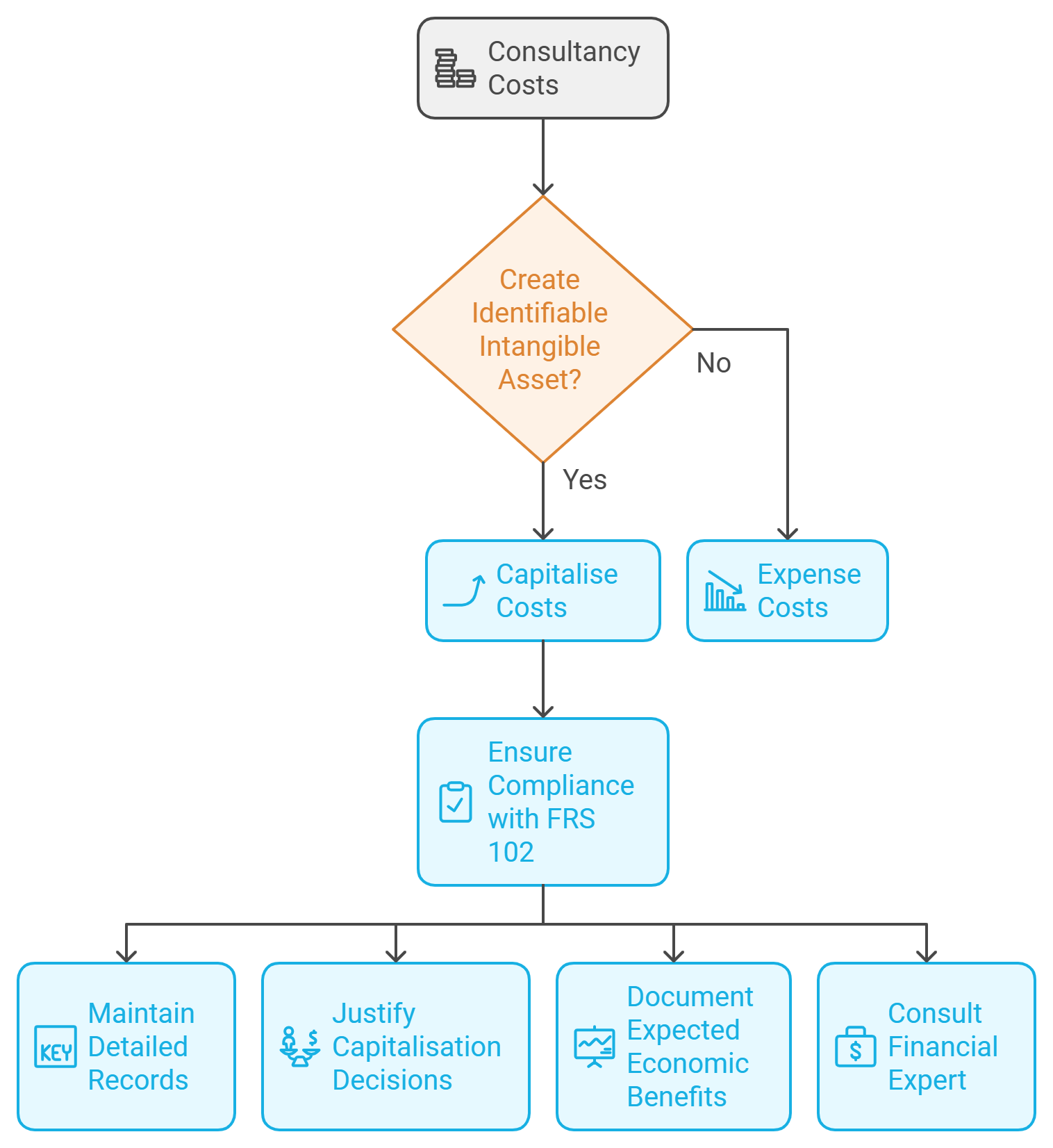

Under FRS 102 Section 18, capitalisation of consultancy costs requires the costs to be associated with creating an intangible asset that meets specific recognition criteria. This guidance ensures that only certain types of expenditures are capitalised, ensuring consistency in financial reporting.

When to Capitalise Lean Six Sigma Consultancy Costs

Under FRS 102, the following criteria must be met for a consultancy cost to be capitalised as an intangible asset:

1. Identifiable Asset

To capitalise costs, there must be a clearly identifiable asset created from the consultancy. An identifiable asset can be sold, transferred, or licensed separately from the business. For instance, if a Lean Six Sigma consultant develops a new proprietary process that improves efficiency, this may be considered an identifiable asset.

2. Control Over the Asset

The business must have control over the asset, meaning it can restrict others from accessing the economic benefits provided by this asset. Ownership or legal rights to the created process or system often indicate control.

3. Future Economic Benefits

There should be a probable expectation that the asset will bring future economic benefits to the business. This could include cost savings, increased revenue, or improved efficiency. If a Lean Six Sigma project generates measurable improvements in operations, it may meet this criterion.

4. Reliable Cost Measurement

Lastly, the costs associated with developing the asset should be measurable and reliable. If the costs of a consultancy project are well-documented and can be accurately calculated, they may be capitalised.

Examples of Capitalisable Consultancy Costs

Here are examples of Lean Six Sigma consultancy costs that might meet the criteria for capitalisation:

- Developing Proprietary Processes: Creating a new, unique workflow that significantly improves business operations.

- Implementing New Software Solutions: If a consultant designs software that enhances operational efficiency, the development costs may be capitalised.

- Long-Term Process Improvements: Where a consultancy project leads to a new process with a clear future benefit, such as increased output, and the business can control this process, the costs may be capitalised.

When to Expense Lean Six Sigma Consultancy Costs

If the consultancy service does not result in the creation of an identifiable intangible asset, the costs should be expensed in the period they are incurred. Expenses should be recorded as regular business costs without any capitalisation if they are related to general improvements without creating new assets.

Examples of Expenses for Consultancy Services

Examples of consultancy services that would be expensed include:

- Routine Operational Advice: Guidance on improving existing workflows that do not lead to a new, identifiable asset.

- Employee Training in Lean Six Sigma: Training services to upskill employees on Lean Six Sigma methodologies should typically be expensed, as these do not create an asset owned by the business.

- Quality Control Audits: If the consultancy performs quality checks without creating an innovative process, these would be expensed.

Documentation and Compliance with FRS 102

To ensure compliance, it’s important to maintain detailed documentation for each consultancy project. This includes:

- Records of Consultancy Scope: Outline the specific services provided and their connection to business objectives.

- Justification for Capitalisation: Document how the consultancy services contribute to the creation of an intangible asset that meets FRS 102 criteria.

- Evidence of Future Economic Benefits: Track metrics or expected improvements resulting from the project to substantiate potential future benefits.

This documentation provides clear evidence for your decision to either capitalise or expense, facilitating a transparent financial audit trail. VA Innovation consultants will always help prepare such documentation as a matter of course.

FAQs about Capitalising vs Expensing Consultancy Costs under FRS 102

What is FRS 102 Section 18?

FRS 102 Section 18 is a UK accounting standard that governs the treatment of intangible assets, providing criteria for when costs should be capitalised or expensed.

When can I capitalise Lean Six Sigma consultancy costs?

You can capitalise consultancy costs if they create an identifiable intangible asset that meets specific criteria, including control, future benefits, and reliable cost measurement.

What types of consultancy costs are typically expensed?

Routine advice, training, and audits that don’t create a new asset are generally expensed in the period they are incurred.

How can I ensure compliance with FRS 102?

To comply, maintain detailed records of consultancy projects, justify capitalisation decisions, and document expected economic benefits. Consulting a financial expert can also be helpful.

Tell us about your business challenges

Contact Us

FAQs About VA Innovation

What is VA Innovation?

VA Innovation is a UK based consultancy that specialises in Lean Six Sigma, helping businesses improve efficiency and reduce waste.

Who benefits from VA Innovation’s services?

Our services are ideal for organisations across industries, including construction, aerospace, and manufacturing, seeking Lean Six Sigma solutions.

Does VA Innovation offer guidance on capitalisation vs expensing?

Yes, we provide clients with insights on how Lean Six Sigma projects may align with financial reporting standards, including FRS 102.

Why choose VA Innovation?

We combine expertise in Lean Six Sigma with practical knowledge of compliance standards, supporting sustainable improvements in process efficiency and financial transparency.

Finally...

Understanding the criteria for capitalising versus expensing Lean Six Sigma consultancy costs under FRS 102 Section 18 can be complex. By following these guidelines and maintaining thorough documentation, businesses can make informed decisions that reflect true value in their financial statements. VA Innovation is here to help you navigate these decisions with expert support in Lean Six Sigma and compliance.

Top Lean Six Sigma Reads: